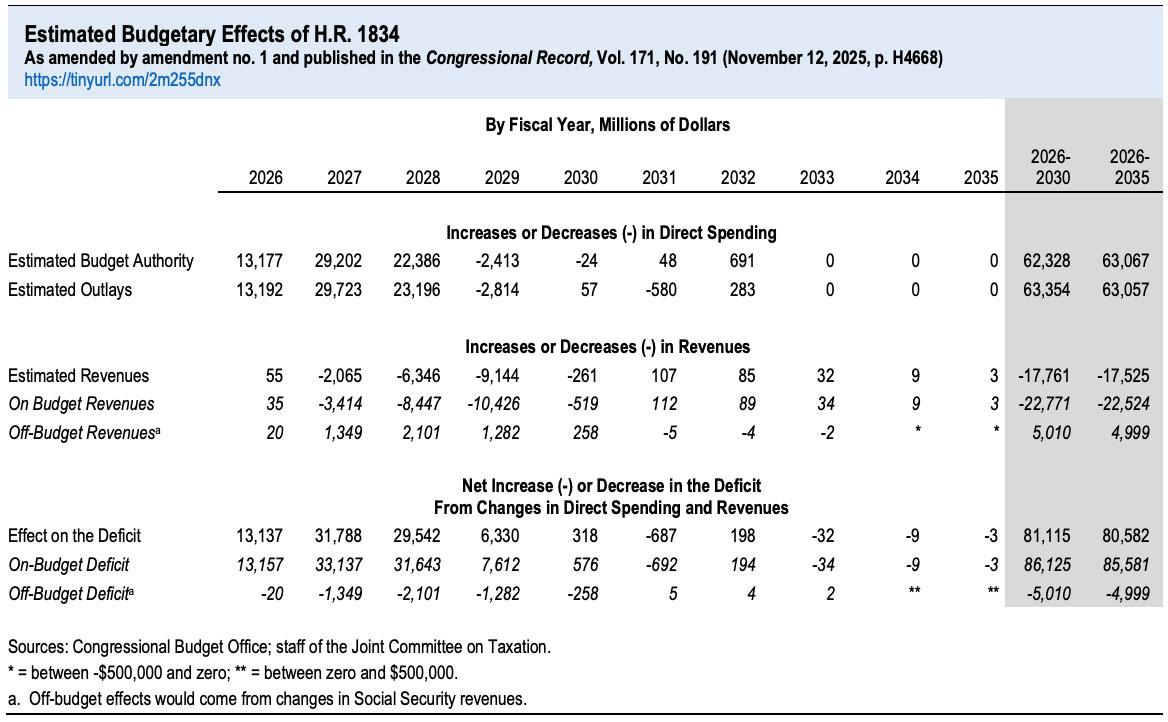

Last summer, when H.R.1, the so-called “Big Beautiful Bill” (aka the Big Ugly BIll or the MAGA Murder Bill) was passed by Republicans, I pointed out that for all the cynical talk about the bill being designed to push the gutting of the U.S. healthcare system out past the midterms to avoid electoral backlash, the truth is that over half of the healthcare-related provisions were actually scheduled to kick in well before then.