Grouching towards Enrollment: My 2026 ACA OEP Guide

Almost exactly a year ago I began my 2025 ACA Open Enrollment Period guide with the following words:

This is the best OEP ever for the ACA for several reasons:

- The expanded/enhanced premium subsidies first introduced in 2021 via the American Rescue Plan, which make premiums more affordable for those who already qualified while expanding eligibility to millions who weren't previously eligible, are continuing through the end of 2025 via the Inflation Reduction Act;

- A dozen states are either launching, continuing or expanding their own state-based subsidy programs to make ACA plans even more affordable for their enrollees;

- 100,000 or more DACA recipients are finally eligible to enroll in ACA exchange plans & receive financial assistance!

What a difference a year can make.

The first and third bullets above are, sadly, no longer the case: Not only are DACA recipients no longer eligible to enroll in ACA coverage, neither are several other classes of non-citizens, including those who were granted asylum for fear of being tortured and even victims of domestic abuse and human trafficking.

In addition, of course, the enhanced federal tax credits which have been a godsend over the past 5 years are still scheduled to expire just over two months from today, largely causing gross premiums to jump by 25% on average and NET premiums to skyrocket by 114% on average nationally starting January 1, 2026.

So no, I'm not gonna put on a cheery face: If the 2025 Open Enrollment Period was the best ever for the ACA, the 2026 OEP is gonna be the worst ever for most of the ~22.7 million current enrollees as well as the millions of others who might be considering newly enrolling in ACA coverage.

Welcome to TrumpCare 2.0.

Having said that, there are still some bright spots (or at least less dim ones). For starters, the second bullet above is still mostly accurate: There are ten states (down from twelve) newly-offering or retooling state-based subsidy programs to cancel out some of the lost federal tax credits or which are newly-implementing other policies to help mitigate the damage.

Beyond that, most of the other enrollment tips I give every year remain good advice, even if they kind of feel like slapping a Band-Aid® on a gaping gunshot wound this year.

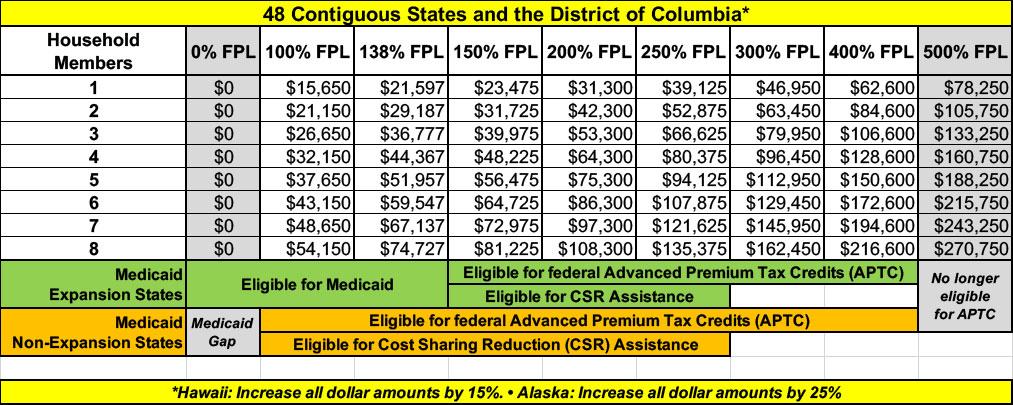

NOTE: Before I begin, it's important to know what the Federal Poverty Level (FPL) will be in 2026. The FPL is a critical part of the formula used to determine eligibility for both premium tax credits as well as Cost Sharing Reduction (CSR) subsidies and Medicaid expansion eligibility in the states which have expanded the program. In addition, the FPL threshold goes up by a few percent each year due to inflation.

This table breaks out the key annual income levels for different FPL thresholds based on the number of members in the household. Note that all of these levels are 15% higher in Hawaii and 25% higher in Alaska:

With all of that in mind, here's some important things to know when you #GetCovered.

1. DON'T DELAY; YOU STILL HAVE UNTIL AT LEAST JAN. 15th IN MOST STATES!

The 2026 Open Enrollment Period officially runs from November 1st, 2025 through January 15th, 2026 in most states, but there are some exceptions at both ends.

- Idaho already launched their 2026 OEP on October 15th, and it only runs through December 15th.

- Massachusetts' OEP ends, as usual, on January 23rd, 2026.

- Virginia's OEP ends on January 30th, 2026.

- California, DC, New Jersey, New York and Rhode Island have final deadlines of January 31st, 2026.

In most states you have to enroll by December 15th in order for your coverage to start on January 1st, with a few exceptions.

Otherwise it won't start until February 1st, 2026. Again, there's a few exceptions:

- Idaho: The December 15th deadline is the only one (no February eligibility)

Massachusetts: December 23rd for January 1st coverageCalifornia, Maryland, Nevada, New Jersey, New Mexico and Rhode Island: December 31st for January 1st coverage

UPDATE: It looks like VIRGINIA residents have until December 31st to enroll for January 1st coverage as well.

UPDATE: Both ILLINOIS and PENNSYLVANIA have extended their deadlines for January 1st coverage out to December 31st as well.

UPDATE: CONNECTICUT has bumped out their deadline for January 1st coverage to December 20th, but you have to actually call the exchange.

UPDATE: VERMONT has extended their deadline for January 1st coverage to December 19th (afternoon)

UPDATE 12/19/25: WASHINGTON STATE has extended their deadline for January 1st coverage to January 15th in response to the flooding state of emergency (you'll have to select January 1st, 2026 as your start date & will be granted eligibility via the Special Enrollment Period as long as you do so before January 15th).

UPDATE 1/02/26: CONNECTICUT has extended their deadline for February 1st coverage to January 31st.

UPDATE 1/05/26: PENNSYLVANIA has extended their deadline for February 1st coverage to January 31st.

UPDATE 1/12/26: ILLINOIS has extended their deadline for February 1st coverage to January 31st.

Here's the official deadlines for coverage starting February 1st for every state:

- California: January 31st

- Connecticut: January 31st (extended!)

- District of Columbia: January 31st

- Illinois: January 31st (extended!)

- Massachusetts: January 23rd

- New Jersey: January 31st

- New York: January 31st

- Pennsylvania: January 31st (extended!)

- Rhode Island: January 31st

- Virginia: January 30th

- Idaho: n/a (Special Enrollment only)

- Washington: (see update above)

- ALL OTHER STATES: January 15th

There are some exceptions to the above:

- Members of federally-recognized Native American tribes or Alaska Natives can enroll in ACA coverage year round.

- There are several state-specific programs which allow eligible enrollees to do so year round, including:

- Connecticut: Covered Connecticut

- District of Columbia: Healthy DC (Basic Health Plan)

- Massachusetts: ConnectorCare

- Minnesota: MinnesotaCare (Basic Health Plan)

- New York: Essential Plan (Basic Health Plan)

- Oregon: Bridge Program (Basic Health Plan)

I'll discuss each of these in more detail below.

In addition, people who are eligible for Medicaid or the Children's Health Insurance Program (CHIP) are eligible to enroll in those programs year-round.

IMPORTANT: Residents who earn less than 150% of the Federal Poverty Level (FPL) used to be able to enroll year-round, but the Trump Regime has ended this.

If you want to enroll outside of the dates above and aren't eligible for any of the exceptions listed, you'll likely have to qualify for a Special Enrollment Period (SEP).

Qualifying Life Experiences (QLEs) which make you eligible for a SEP include things like:

- Losing employer-sponsored healthcare coverage

- Getting married or divorced

- Giving birth/adopting a child

- Turning 26 and having to move to your own policy

- Losing eligibility for Medicaid or CHIP

- Moving out of your current rating area

IMPORTANT CAVEAT: This year in particular, a lot of people and even a lot of insurance brokers are advising people to hold off a bit before enrolling on the off chance that there's a last-minute agreement by Congress to extend the enhanced tax credits after all.

This is understandable (my wife and I are holding off a bit ourselves), but I would still caution you not to wait too long: Not only are there the normal reasons, but you also don't want to risk the servers or call centers being overloaded by everyone trying to enroll at the same time at, say, 10pm on December 14th or whatever.

2. ONLY ENROLL VIA AN OFFICIAL ACA HEALTH EXCHANGE OR AN AUTHORIZED ENROLLMENT PARTNER.

ACA financial subsidies are only availalble to eligible enrollees who sign up through an official ACA exchange or an authorized 3rd-party exchange entity, known as an Enhanced Direct Enrollment (EDE) entity.

There's a ton of junk plans and scam artists out there, especially these days. Fraudulent plans are being hawked endlessly via both robocalls, spam emails and fly-by-night websites.

IMPORTANT: Scams & Junk Plan pitches are going to be an even worse problem for 2026 because of the expiring tax credits & other Trump regime policy changes which are making it more difficult for people to enroll in legitimate ACA plans or to qualify for legitimate financial help.

If you're enrolling online, make sure to use one of the official ACA exchange websites:

- CALIFORNIA: Covered California

- COLORADO: Connect for Health Colorado

- CONNECTICUT: Access Health CT

- DISTRICT OF COLUMBIA: DC Health Link

- GEORGIA: Georgia Access

- IDAHO: Your Health Idaho

- ILLINOIS: Get Covered Illinois (new!)

- KENTUCKY: kynect

- MAINE: CoverME.gov

- MARYLAND: Maryland Health Connection

- MASSACHUSETTS: MA Health Connector

- MINNESOTA: MNsure

- NEVADA: Nevada Health Link

- NEW JERSEY: Get Covered NJ

- NEW MEXICO: beWellnm

- NEW YORK: NY State of Health

- PENNSYLVANIA: Pennie

- RHODE ISLAND: HealthSource RI

- VERMONT: VT Health Connect

- VIRGINIA: VA's Insurance Marketplace

- WASHINGTON STATE: WA Healthplan Finder

- As for EDEs, it's important to note that some of these may also sell non-ACA compliant plans. The largest EDE, HealthSherpa, only sells on-exchange ACA-compliant policies. Full disclosure: They advertise on this website.

Also note that while some insurance carrier websites are also hooked into the federal exchange via an EDE, they (understandably) only list their own plans. I still recommend only using one of the websites listed above. Remember, whether via an official exchange site or an EDE, you have to enroll on-exchange to be eligible for financial help!

3. DOUBLE-CHECK YOUR 2026 INCOME TO SEE IF YOU'RE ELIGIBLE FOR FINANCIAL HELP.

As i note in the table above, the household Federal Poverty Level (FPL) threshold is critical in determining whether or not you're eligible for Advanced Premium Tax Credits (APTC) as well as Cost Sharing Reduction (CSR) assistance...and while the enhanced tax credits expiring will make the APTC levels far less generous across the board, the FPL income thresholds inching up a few percent each year helps mitigate that (a bit).

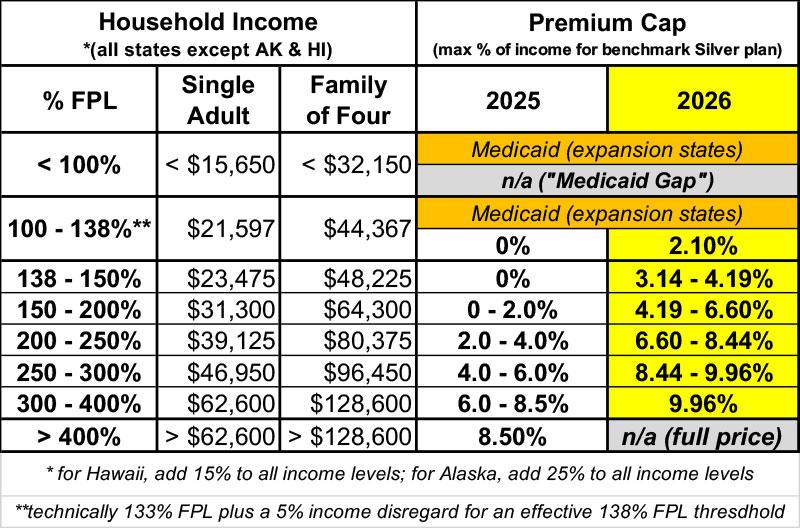

The table below compares the APTC income eligibility formula for 2025 with the enhanced tax credits to what it will change to starting in January 2026 without them. The FPL income levels are for 2026.

For example: $40,000 for a single adult would be 266% FPL this year but only 256% FPL in 2026.

A single adult who earns exactly $40,000 each year would be limited to paying around 4.6% of their income for the benchmark Silver plan in 2025 (~$153/month)...but in 2026 they'd have to pay around 8.9% of their income for the benchmark Silver plan (~$297/month).

As you can see, enrollees across the entire income spectrum are going to be hit hard, with the ugliest outcomes in terms of percent of income being found at the low and high ends (enrollees earning less than 150% FPL will go from paying $0 for the benchmark plan to as much as 4.2% of their income, while those earning over 400% FPL will immediately lose eligibility for any tax credits and will have to pay full price...which could be devastating, especially for older enrollees).

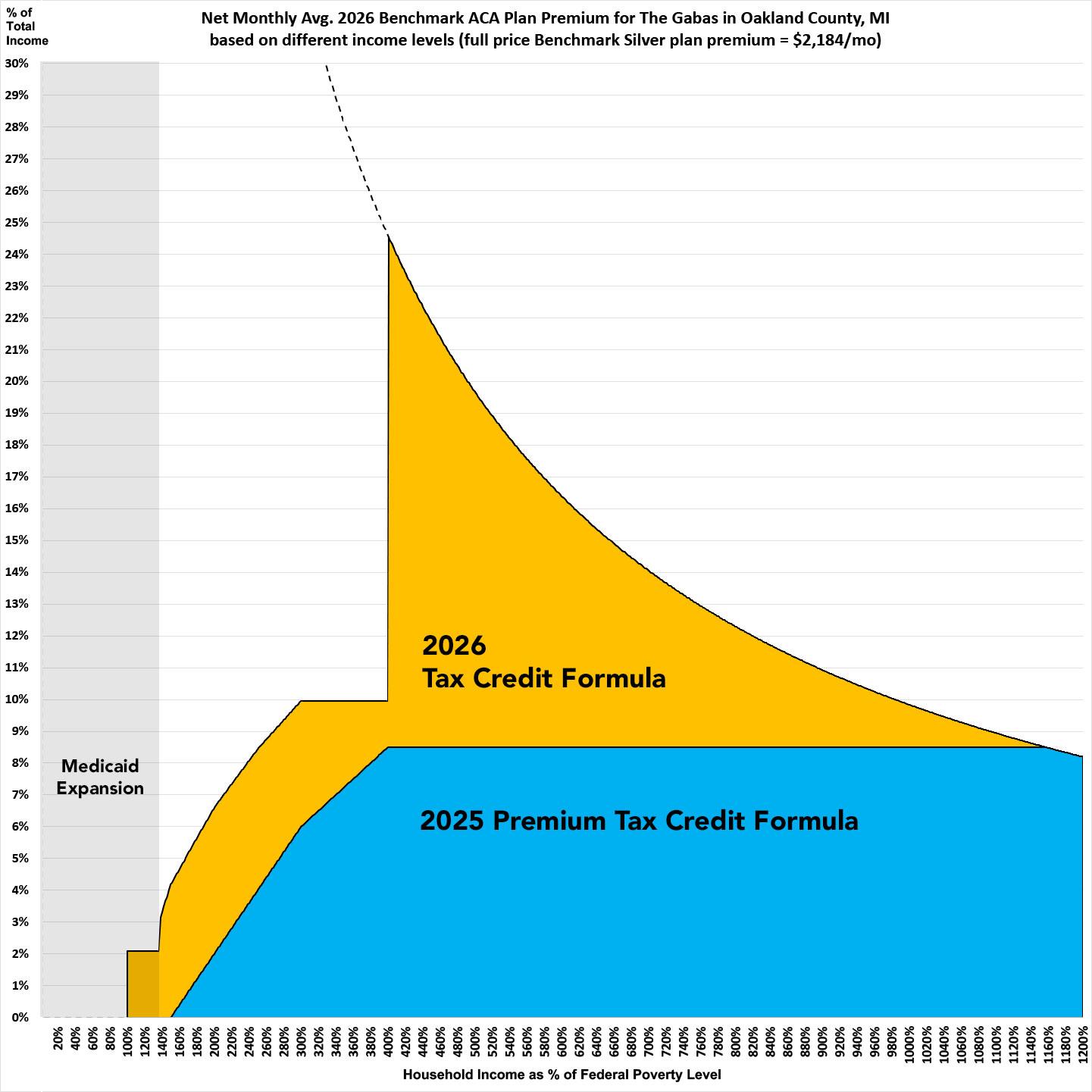

Here's what this looks like visually (I'm usting my own family of 3 people here in Oakland County, Michigan for this example; it will vary depending on where you live and your household makeup):

4. IF YOU EARN MORE THAN 400% FPL, THERE ARE WAYS TO LEGALLY GET YOUR 2026 MAGI INCOME BELOW THE SUBSIDY CLIFF THRESHOLD.

I'm neither an accountant nor a tax attorney, but there are several perfectly legal ways for people with incomes over the 400% FPL "subsidy cliff" threshold to push their household back below the cut-off level so that they'll remain eligible for ACA tax credits after all (you can use these to increase your subsidy even if you're already below 400% FPL, for that matter). From my friend & colleague Louise Norris:

A lower income and more adjustments to income will reduce MAGI. You should consult your tax advisor to consider the available deductions/adjustments on your tax return that are above the line that shows your AGI since reductions to your AGI will also reduce your ACA-specific MAGI.

Tax-deductible contributions to a traditional individual retirement account (IRA) will reduce your ACA-specific MAGI. Your tax advisor should be able to explain the details of this to you, including how to determine whether you’re eligible to make tax-deductible contributions to a traditional IRA.

In addition, your tax advisor can explain how contributing to an employer-sponsored pre-tax retirement plan like a 401(k) will lower your ACA-specific MAGI.

...If you’re self-employed, your tax advisor can advise whether it is in your best interest to set up a self-employed retirement plan such as a SEP IRA, SIMPLE IRA, or Solo 401(k). Talk with your tax advisor to see if one makes sense for you. Keep in mind that these retirement plans for self-employed people have contribution limits that are potentially higher than those of traditional IRAs allowing people to reduce their MAGI by a larger amount than a traditional IRA would allow.

If you have an HSA-eligible high-deductible health plan (HDHP), contributions to an HSA will reduce your ACA-specific MAGI. Your tax advisor should be able to answer any questions you have about this. It's important to note that starting with the 2026 plan year, all Bronze and catastrophic plans purchased in the health insurance Marketplace will be considered HDHPs. So if you enroll in one of these plans, you'll be eligible to contribute to an HSA, as long as you don't have any additional major medical coverage.

Self-employed people may also deduct their health insurance premiums, which may lower their MAGI, but it gets a bit complicated if that’s the factor that makes you eligible for a premium subsidy.

5. HOWEVER, BE CAREFUL, BECAUSE THERE'S NO LONGER A CAP ON HOW MUCH YOU HAVE TO PAY BACK IF YOU UNDERESTIMATE YOUR INCOME...

Until now (and up through the end of 2025), there's been a limit on how much of their federal tax credits ACA enrollees have to pay back to the federal government if they underestimated their annual household income...which is to say, if they overestimated the amount of tax credits they were technically eligible for.

- For the 2025 tax year, enrollees whose household income ends up being less than 200% FPL only have to pay back a maximum of $375 if they're single or up to $750 for any other tax filing status.

- If they earn between 200 - 300% FPL, they're limited to paying back no more than $975 if they're single or $1,950 for any other filing status.

- And if they earn between 300 - 400% FPL, they're limited to paying back no more than $1,625 if single or $3,250 for other filing statuses.

- If their MAGI income is over 400% FPL, however, they'll have to pay whatever the excess APTC ends up being.

HOWEVER, starting with the 2026 calendar year, there will no longer be ANY caps on what portion of excess APTC has to be repaid, regardless of what your income bracket is.

If you overestimate your tax credits by $1,000 next year, you'll have to pay back $1,000. If you overestimate by $5,000, you have to pay back all $5,000. And if you think you'll end up below that 400% FPL threshold but end up with a 2026 MAGI of 401% or higher...you'll have to pay back every dime, which could potentially be $10,000 or more.

So proceed with the HSA/IRA ideas laid out in #4 above with caution.

6. IF YOU'RE ENROLLED OFF-EXCHANGE, SEE IF YOU CAN ENROLL ON-EXCHANGE INSTEAD.

As far as I can figure, somewhere around ~2 million Americans are still enrolled in OFF-exchange, ACA-compliant individual market policies. Historically, the main reason for this has been that they didn't qualify for financial help, so didn't see the point of filling out any additional forms by enrolling on-exchange.

The reality, however, is that many of these off-exchange enrollees may have been eligible for ACA subsidies after all if they had enrolled in the exact same plan but had done so via their ACA exchange instead of directly through the carrier.

With the enhanced tax credits expiring, there's going to be a lot fewer people who benefit by moving from off-exchange to on-exchange plans, but I'd still strongly urge people to at least check into it, especially if there's any chance of your 2026 household income being being less than 400% FPL (see the table above for how much that will be).

Full-price/unsubsidized ACA premiums are increasing by a whopping 25% on average next year, so I can't stress this enough: If you enroll off-exchange, there's a chance you'll be leaving thousands of dollars in savings on the table.

7. THE FAMILY GLITCH DOESN'T APPEAR TO BE BACK...YET.

Due to how the U.S. Treasury Dept. and the Obama Administration interpreted an obscure provision of the Patient Protection & Affordable Care Act regarding employer coverage affordability thresholds over a decade ago, for years there were several million people who really should have been eligible for ACA subsidies but who weren't.

The very short version of the problem was this:

- Let's say you have healthcare coverage for yourself only through your employer, and you only have to pay, say, 8% of your annual household income for your premiums

- However, you're married with two kids, and adding them would tack on another, say, 12% in premiums, covering all four of you would cost 20% of your household income.

- Because your individual premiums come in at less than ~9.96% of your income, the rest of your family doesn't qualify for ACA subsidies even though the premiums for the family as a whole costs more than the maximum amount you'd otherwise have to pay for an ACA exchange plan.

Thanks to changes implemented by Biden Administration, since 2022, this has longer been an issue for most of these folks!

HOWEVER...One of Donald Trump's first actions upon re-taking office back in January was to revoke a long list of Biden-era Executive Orders, including the one which led to the Family Glitch being closed. To the best of my knowledge (backed up by my colleague Louise Norris, who I trust on this), the IRS hasn't actually changed their official rules on the issue as of yet...so as far as I know, this population is still safe for another year.

8. MULTIPLE STATES ARE TAKING ACTION TO MITIGATE THE DAMAGE (or already had supplemental subsidy programs in place):

I already did a separate write-up about this, but am reposting the details here as well:

In late August, Covered California, the state-run ACA exchange, announced that they'll be retooling & expanding their existing supplemental financial assistance program to cancel out a portion of the lost federal funding:

In 2025, Gov. Newsom and the California Legislature increased the amount of state funds available for the enhanced cost-sharing reduction program, appropriating $165 million to expand eligibility. As a result, Californians with incomes above 200 percent of the federal poverty level ($31,300 for an individual or $64,300 for a family of four) were eligible to enroll in an Enhanced Silver 73 plan with no deductibles and reduced out-of-pocket costs.

That's right: For the past year and a half, nearly half of California's ACA enrollees have paid no deductibles thanks to the state CSR program. I don't know the exact number, but currently it applies to enrollees who earn up to 250% FPL, which includes over 1.1 million of the ~2.4 million residents enrolled in ACA individual market plans.

This year, California is continuing to take proactive steps to shield its lowest-income enrollees from the steepest rate increases and reduce costs for consumers should the enhanced tax credits expire. For 2026, the state has allocated $190 million to provide state subsidies for individuals earning up to 150 percent of the federal poverty level, ensuring monthly premiums remain comparable to 2025 levels for those with an annual income of $23,475 for an individual or $48,225 for a family of four. It would provide some additional assistance to those earning up to 165 percent of the federal poverty level.

If I'm reading this correctly, and assuming the 2023 table still applies, it means:

- enrollees earning up to 150% FPL will still be eligible for $0-premium plans...but will face a modest $75 deductible

- enrollees earning 150 - 165% FPL will receive at least some extra premium assistance...but will go back to an $800 deductible

- enrollees earning 165% - 200% FPL will go back to an $800 deductible, plus the other premium hikes

- enrollees earning 200 - 250% FPL will go back to a $5,400 deductible, plus the other premium hikes

Around 290,000 enrollees are below 150% FPL this year, so this is great news for around 12% of the CA ACA population (I'm including off-exchange enrollees in the total). The ~650,000 or so who are unsubsidized will "only" face the 10.3% premium increases (not great, but not devastating). The press release doesn't provide detail on what "some" assistance means for the 150 - 165% FPL segment.

While this funding will provide a meaningful lifeline for the lowest-income Covered California enrollees, it far from fills the $2.1 billion hole the federal government would be leaving.

Put another way, California is canceling out around 9% of the lost federal subsidies (but they're mostly doing so by reworking the money which has been going to further reduce deductibles).

Emergency legislation taken by the state legislature recently is supposed to generate up to $100 million in funding to replace a portion of the lost federal subsidies:

DENVER - Colorado Insurance Commissioner Michael Conway released the following statement on Governor Polis signing HB 25B-1006 into law, legislation that provides funding to the individual healthcare market to reduce catastrophic premium increases:

“I’m grateful Colorado lawmakers heeded our call about catastrophic price increases for the individual healthcare market and passed a temporary fix this special session. This stopgap measure will provide crucial funding to reduce the rise in premium costs for working families. But without Congress stepping up to extend enhanced premium tax credits, tens of thousands of hardworking Coloradans will lose their healthcare, and those who remain enrolled can expect to see average net rate increases of more than 100%, and for many, almost 200%.”

Total lost federal tax credit funding for Colorado is pegged at around $230 million next year, so this should backfill perhaps 43% of that overall.

Again, the additional funding in CO will enhance an existing supplemental program which, until now, provided $50/mo for the first household member and $18/mo for additional members, but only for households earning up to 200% FPL.

My colleague Louise Norris found the beefed-up breakout of the state-funded premium assistance for next year:

Subsidy Structure for Households Below 400% FPL:

1. For the first enrollee in a household, the enhanced premium subsidy shall be the lesser of $80 per member per month (PMPM) or the premium balance after federal APTC has been applied.

2. For each additional member in the household who is subject to a premium, the enhanced premium subsidy shall be the lesser of $29 per member per month (PMPM) or the premium balance after federal APTC has been applied.

For households with more than three dependents under age 21, no enhanced premium subsidy will be applied for any subsequent dependents with $0 premium.

Unlike California, Colorado's program goes across-the-board to enrollees regardless of income (up to 400% FPL), but it should still result in the vast majority of enrollees who earn less than 150% FPL continuing to qualify for $0 premiums (150% FPL = $23,475 for a single adult next year; 2.1% of that will be $493/year or $41/month), along with some portion of those who earn up to 200% FPL.

One other bit of negative news: CO's unique "OmniSalud" program for undocumented immigrants appears to be about to take a crippling 80% funding blow. Frankly I'm surprised they're gonna be able to keep it going at all under the circumstances.

The Covered Connecticut program raises the actuarial value of ACA plans to a stunning 100% (ie, no cost sharing at all) for all Silver CSR enrollees earning up to 175% FPL. This even includes no-cost dental insurance and non-emergency medical transportation.

UPDATE: Connecticut Governor Net Lamont also just announced that the state will be backfilling $70 million of the lost federal tax credits for ACA enrollees (around 24% of the total), although the exact details are still being worked out.

This one is more of a lateral change than a positive or negative one (although it's slightly negative). For the past 15 years, the District of Columbia has utilized a special waiver which expanded Medicaid coverage eligibility far beyond the normal ACA Expansion level of 138% FPL. DC residents earning up to 215% FPL (technically 210% + a 5% tax disregard) have been able to enroll in Medicaid in the nation's capital.

This is changing starting in 2026: The District decided not to renew the waiver for another five years and instead is replacing it with a Basic Health Plan program for low-income residents earning between 138% - 200% FPL. The new program, called Healthy DC, will save the District money while also protecting a chunk of their Medicaid enrollees from the Work Reporting Requirements mandated by the One Big Ugly Bill.

The main downside is that a few thousand current enrollees who earn between 200 - 215% FPL will be cut off from eligibility in either program.

Once again, Maryland is retooling an existing program (which is currently designed to provide extra assistance specifically for enrollees aged 18 - 37 only) into a more robust arrangement to backfill lost federal assistance:

However, the state has created a new subsidy program for all ages for those who are under 400% of the federal poverty level to help offset the expiration of the enhanced federal subsidies. The state subsidy program will replace 100% of the enhanced federal subsidies for those under 200% of federal poverty level and will replace 50% of the enhanced federal subsidies for those between 200% and 400% of the federal poverty level. Those over 400% of the poverty level will not receive a state subsidy, and will be most impacted by the loss of federal enhanced APTC, unless Congress takes immediate action.

Of the ~245,000 on-exchange ACA individual market enrollees in Maryland, around ~79,000 earn between 100 - 200% FPL, while another ~79,000 earn 200 - 400% FPL. Around 16,000 earn more than 400% FPL, and over 46,000 have an unknown household income. Finally, there's around ~49,000 off-exchange enrollees who aren't eligible for any tax credits regardless.

Basically, around 79,000 will be held fully harmless by the lost federal subsidies; another 79,000 will be hit for half the lost assistance; and the rest are divided between those currently subsidized who lose all federal assistance and have to pay 13.4% more and those who weren't subsidized in the first place and will "only" have to pay 13.4% on average.

MA has extended their 2-year "500% FPL ConnectorCare Pilot Program" out by another year through the end of 2026:

Today, the Massachusetts Health Connector Board of Directors approved regulatory changes that will expand access to the Marketplace’s landmark ConnectorCare program through a two-year pilot program, creating the opportunity for tens of thousands of people to access more affordable health care. The ConnectorCare program is currently available for people who make up to 300 percent of the Federal Poverty Level (FPL) and do not have access to health coverage, such as through an employer.

...The regulatory changes were required after Governor Maura Healey signed the Fiscal Year 2024 state budget last week, which included expanding the income limits of ConnectorCare from 300 percent of the Federal Poverty Level to 500 percent and all Marketplace carriers to participate in the program for the first time. Together, the changes mean more residents than ever before will qualify for more help lowering health care costs since the creation of the Health Connector in 2006 and will also have greater access to more plan options.

Again, the expanded program (from 300% FPL to 500% FPL) was supposed to end this year, but the 2026 annual budget bumps it out by one more year, which should mean the additional ~50,000 enrollees who gained eligibility for the program can stay on it through the end of 2026 instead of 2025.

Around 100,000 Minnesota residents with household income is up to 200% FPL are enrolled in the states expanded MinnesotaCare Basic Health Plan program.

Minnesotacare features $0 premiums for households earning up to 160% FPL and $4 - $28 premiums on a sliding scale for households earning 160 – 200% FPL. Children up to 20 years old have no cost sharing, and adults 21+ only pay $100 for ER visits and have very low co-pays for other typical services.

First, Nevada is launching their "Battle Born State Plans" which are being billed as a "Public Option" even though it's really only a quasi-PO, similar to the existing programs in both Washington and Colorado.

I last wrote about Nevada's initiative four years ago; at the time it really was supposed to be a true Public Option (that is, a major medical healthcare plan administered by the state itself which anyone could buy into at a more competitive price than private plans).

Unfortunately, since then the program has ended up being watered down quite a bit:

Nevadans looking for health insurance on the state’s Affordable Care Act marketplace this fall have a new, more budget-friendly option to review: Battle Born State Plans.

...Approximately 35,000 people are projected to purchase the Battle Born Plans, a number that could vary given rising health care costs and the expiration of certain federal subsidies.

Basically, like in WA & CO, the state contracted with several private insurance carriers to create a new category of ACA-compliant Qualified Health Plans (QHPs) to sell on the exchange. They have to meet the same requirements as any other exchange plan, except that they're legally required to hit certain premium reduction targets. That's pretty much the only distinction besides the branding.

...Insurance carriers offering the plans are required to align their networks with Medicaid managed care networks to ensure sufficient access to care.

...Under Nevada law, carriers offering the new state plans must satisfy premium reduction targets over the next four years, finishing at 15 percent lower than the average premium on the market.

I don't know what the interim targets are, but it sounds like 2026 premiums are supposed to average perhaps $20/mo less or so (at full price) than they would otherwise...except that's in the context of average unsubsidized premiums going up by $124/mo. Still, every dollar counts I suppose.

Nevada is also launching a new Reinsurance Program as well:

Reinsurance essentially works as insurance for insurance companies, paying a portion of high-cost claims and thus allowing insurers to lower the premiums for individual health insurance plans.

As reinsurance programs help lower insurance premiums, the amount of federal dollars spent on ACA tax credits also goes down. Instead of keeping those dollars, the federal government passes that money through to the state to help fund the reinsurance program and maintain lower premiums and market stability.

State officials said the savings will be felt marketwide as the reinsurance payments will be available to all licensed carriers in the individual market. The reinsurance program also helps the three state plan carriers meet their premium reduction targets.

...By the end of 2029, state officials estimate that the reinsurance program and public option will bring between $290 million and $322 million in new federal savings to Nevada.

Under the agreement approved by the federal government, a large portion of these funds will be used to implement a reinsurance program, with additional funds in future years being spent on a loan retention program for health care providers and a quality incentive program for carriers and provider networks.

I wrote up a more detailed explainer of how state-based reinsurance programs work years ago. The bottom line is that it reduces gross premiums (which helps cut costs for unsubsidized enrollees), but doesn't do anything to reduce the net cost for subsidized enrollees. In fact, it usually has the opposite effect for those who earn 200 - 400% FPL, but that gets kind of wonky.

In late August I reported that the state is, like CA, CO & MD, retooling and enhancing their own supplemental state-based subsidy program to help cancel out as much of the damage from the expiring federal funding as possible:

...The state marketplace launched in 2020 with a state subsidy – called New Jersey Health Plan Savings – to further lower monthly premiums for consumers, beyond the tax credits offered by the federal government. The Department is estimated to provide $215 million this year to support state subsidies, New Jersey Health Plan Savings, providing greater affordability in the market by lowering premiums for hundreds of thousands of New Jerseyans.

Unfortunately, the press release doesn't specify how this funding will be allocated in 2026 (will they keep it the same as now or modify it as California is doing?). The only guidance I have on the state-based subsidy program is from this letter back in June (h/t Louise Norris for the link):

"Given the uncertainty created by the Congress, the Department is not yet able to determine the allocation of New Jersey Health Plan Savings (NJHPS) if the enhanced advance premium tax credits (APTC) are not extended, but the Department will ensure the necessary adjustments to maximize the NJHPS. However, since the federal APTC are expected to total almost $3 billion and the enhanced portion of that is estimated to be over $500 million in 2025, it is impossible for the NJHPS to compensate for enhanced APTC if APTC are not extended."

So we're talking about perhaps 40% of the lost federal subsidies, with the funding mostly coming from retooling the existing state subsidy program, which reduces premiums by anywhere between $20 - $100/month per enrollee depending on their household income (h/t Andrew Sprung for this info):

- Income up to 150% FPL: $20/mo

- 150 - 200% FPL: $40/mo

- 200 - 250% FPL: $50/mo

- 250 - 400% FPL: $100/mo

- 400 - 500% FPL: $50/mo

Unlike the other states on this list which have only been able to backfill a portion of the federal tax credits which are set to expire, New Mexico has pulled of something of a miracle:

While it appears that Congress will allow enhanced federal Premium Tax Credits to expire, New Mexico’s Health Care Affordability Fund (HCAF) will cover the loss of the enhanced premium tax credits for households with income under 400% of the Federal Poverty Level (or $128,600 for a family of four), providing up to $68 million in premium relief for working families who enroll in coverage through BeWell in 2026. Federal and state premium assistance will continue to reduce the impact of the rate increases.

I confirmed independently that yes, this means they're covering 100% of the lost subsidies for every enrollee under 400% FPL who currently qualifies for them...but then they went one step further:

...A Senate committee Thursday morning agreed on a bipartisan vote to advance HB2, intended to protect about 6,300 New Mexicans from huge health care premium increases if federal tax credits expire as scheduled later this year.

...Accompanying the legislation the committee approved Thursday is a $17.3 million appropriation into the Health Care Affordability Fund, which the HCA oversees, to cover the premiums for policyholders whose income is 400% of more of the federal poverty line. The Legislature earlier this year approved funding to cover the tax credits for those who make under that threshold.

Sure enough, the bill has since passed the NM Senate and has been signed into law by Gov. Lujan-Grisham.

This means that ALL New Mexico exchange enrollees will be protected from the expiring credits.

What's more impressive still is that also unlike other states, NM has somehow managed to find the funding to do this without cannibalizing their existing "Turquoise Plan" supplemental subsidy program:

This program was introduced in 2023; it reduces benchmark Silver premiums for enrollees earning up to 200% FPL down to $0, while also reducing them by lesser amounts for enrollees earning between 200 - 400% FPL. It also dramatically upgrades the cost sharing reduction subsidies while rebranding Silver CSR plans as “Turquoise Plans” for easier consumer marketing.

A stunning 1.3 MILLION New Yorkers are now enrolled in this Basic Health Plan program; similar to MinnesotaCare, residents earning up to 200% FPL are eligible for the Essential Plan, which has been expanded to the point that enrollees pay NO premiums and have NO deductibles! In addition, enrollees earning up to 150% FPL pay almost nothing in cost sharing, which is pretty nominal for those earning 150 - 200% FPL.

IMPORTANT: For the past two years, New York has expanded Essential Plan eligibility to households earning up to 250% FPL...unfortunately, since funding for BHPs is based primarily on federal tax credit levels, the expiring enhanced tax credits also means that New York has to revert their BHP program back down to the 200% FPL cut-off threshold, which will kick ~450,000 current enrollees back over to exchange plans.

IMPORTANT: For the past two years, New York has expanded Essential Plan eligibility to households earning up to 250% FPL...unfortunately, since funding for BHPs is based primarily on federal tax credit levels, the expiring enhanced tax credits also means that New York has to revert their BHP program back down to the 200% FPL cut-off threshold, which will kick ~450,000 current enrollees back over to exchange plans.

Last year, Oregon became the third state to launch a Basic Health Plan (BHP) program, dubbed the "Bridge Program," for adults earning between 138 - 200% FPL. The Bridge Program is similar to the BHP plans in DC, Minnesota and New York.

Available to Vermont residents earning up to 300% FPL, Vermont Premium Assistance is unusual in that they reduce net premiums by 1.5 percentage points...which means that some low-income enrollees are technically paying negative premiums. In reality, the "excess" subsidies just go to cover any premiums for services not covered by federal subsidies (no, you don't actually get paid for enrolling).

Cascade Care Savings are available for enrollees earning less than 250% FPL who enroll in Silver or Gold “Cascade Care” plans (Cascade Care plans are Washington’s quasi-”public option” ACA policies). This further reduces net premiums down to as low as $0/month; most pay $10/month or less. Cascade Care plans have deductibles/co-pays around $1,000 lower than non-Cascade Care Silver plans.

ARKANSAS, ILLINOIS & WASHINGTON:

Most of the above states (Nevada excepted) are mitigating the looming net premium hikes by offering direct supplemental financial assistance to enrollees, mostly those under 400% FPL.

Three more states are going a different route: PREMIUM ALIGNMENT.

I wrote up a wonky explainer about how "Silver Loading" works a few years back, and wrote up a longer piece about Premium Alignment (which Silver Loading and Silver Switching are subsets of) here, so I won't rehash the details again.

Suffice it to say that this is a healthcare policy pricing strategy which maximizes the federal tax credit funding available for a significant chunk of ACA enrollees while (if done properly) holding all enrollees harmless and which does so without raising taxes or fees at either the state or federal level...all while simultaneously bringing the ACA itself in line with the legislative text of the law!

Not a bad hat trick! There are actually a number of other states which have already implemented Premium Alignment pricing in the past, including both blue states like Maryland, Colorado and New Mexico as well as red states like Texas and Wyoming, so this is truly a nonpartisan, common sense thing which every state should be doing but only a dozen or so far actually are.

9. MILLIONS OF PEOPLE ARE ELIGIBLE FOR "SECRET PLATINUM" PLANS (LABELED AS SILVER)!

As I explain in detail here, if your household earns less than 200% FPL in any state, make sure to choose a SILVER plan!

Thanks to the ACA's Cost Sharing Reductions (CSR) system, you'll receive additional financial help which will lower your deductible, co-pays and coinsurance so much it effectively transforms Silver plans into Platinum plans!

Thankfully, unlike premium subsidies, the CSR subsidy formula is not being weakened in 2026, so this is still good advice regardless of the premium tax credit debacle.

10. VIA PREMIUM ALIGNMENT & SILVER LOADING, SOME SUBSIDIZED ENROLLEES MAY BE ABLE TO GET BRONZE OR EVEN GOLD PLANS FOR FREE!

As I explained here, due to a long, strange series of events, subsidized enrollees earning 200% FPL or more may end up getting a Gold plan for less than Silver, or a Bronze plan for free!).

In 2021, David Anderson ran an analysis and finds that there were 820 counties where at least one Gold plan was priced lower than the benchmark Silver plan even at full price! Once you add Silver Loading into the mix, this means many people will qualify for a ZERO-PREMIUM GOLD plan even if they earn over 200% FPL!

Even with the enhanced tax credits expiring, some people will still be eligible for these, although not nearly as many.

UPDATE: Here's the 14 states where Gold plans cost less than Silver plans on average!

11. THE INDIVIDUAL MANDATE IS STILL AROUND IN FIVE STATES!

The federal ACA individual mandate was reduced to nothing in 2019, so it isn't an issue any longer...but there are actually five states which have their own healthcare coverage requirement/penalty:

- CALIFORNIA: At least $900/adult + $450/dependent child

- DISTRICT OF COLUMBIA: At least $795/adult or $397.50/child

- MASSACHUSETTS: $300 to $2,244 per person depending on income level

- NEW JERSEY: At least $695/adult or $348/child

- RHODE ISLAND: At least $695/adult or $348/child

The financial penalty for not having coverage (assuming you don't qualify for an exemption, which some people will) will be charged when residents file their 2025 state taxes in spring 2026.

12. SOME CARRIERS ARE EITHER NEWLY ENTERING OR EXITING STATES

Every year sees churn on the ACA markets as new carriers enter or expand their coverage areas to more counties/states...or as currently-participating carriers pull out of them. In addition, existing carriers often add new plans or phase out current ones.

Here's my most recent compilation of new entrances and exits for 2026 (it's possible that I've missed a few):

Entries:

- Alabama: Oscar

- Florida: Community Care, Cigna HMO, Ambetter (off-exchange only); Oscar splitting into 2 divisions

- Iowa: Avera Health

- Minnesota: Health Partners

- Mississippi: Oscar

- Nevada: CareSource, Community Care (Anthem)

- Texas: Harbor Health

- Washington: Harbor Health

Exits (all of these are pulling entirely out of the state with one exception):

- Arizona: Aetna/CVS (Banner)

- California: Aetna/CVS

- Delaware: Aetna/CVS

- Florida: Aetna/CVS

- Georgia: Aetna/CVS

- Illinois: Health Alliance Medical Plans, Aetna/CVS, Aetna Life Insurance, Quartz Health Benefit Plan

- Indiana: Aetna/CVS

- Kansas: Aetna Life Insurance

- Kentucky: CareSource KY

- Maryland: Aetna/CVS

- Michigan: HAP CareSource, Molina, Physicians Health Plan, Meridian (partial)

- Mississippi: Primewell

- Missouri: Aetna Life Insurance

- Nevada: Aetna/CVS

- New Jersey: Aetna Life Insurance

- North Carolina: Aetna/CVS, Celtic Insurance (Wellcare)

- Ohio: Aetna/CVS, AultCare

- Texas: Aetna/CVS

- Utah: Aetna/CVS

- Virginia: Aetna/CVS, Innovation

- Wisconsin: Chorus Community, Molina

- Wyoming: Mountain Health Co-OP

Any time a carrier reduces their participation in a given county or state it means that anyone currently enrolled in their policies will either be automatically "mapped" to a similar plan with a different carrier or they have to actively seek out a new policy to enroll in.

If this is all confusing, I'm afraid you'll receive a lot less assistance than in past years in most states because...

13. THE TRUMP REGIME IS GUTTING THE FEDERAL NAVIGATOR PROGRAM BY 90%.

As noted by KFF earlier this year:

The U.S. Department of Health and Human Service’s announcement of a 90% cut in Navigator funding, while not surprising, is the biggest cut since the program began. The current plan year funding of $100 million will be reduced to $10 million for next year. Congress created the Navigator grant program to provide consumers with “fair and impartial information and services” related to ACA Marketplace coverage.

During the first Trump administration, funding was reduced by 84%, resulting in staff layoffs, reduced outreach, and limitations on the time these assisters can spend with individuals. These funds were restored in 2021 under the Biden administration and last year, the administration announced up to $500 million over five years, providing $100 million for the 2025 plan year– the largest grant amount since the program began. Grants awarded for plan year 2024 (as well as plan year 2025) disproportionately serve patients and consumers in Republican-led states and rural areas (Figure 1).

...The ACA requires Navigators to perform functions much broader than enrolling individuals in ACA coverage. These entities also conduct public education and outreach activities, especially in underserved communities where people’s income can fluctuate during the year due to job loss and other circumstances beyond their control. For this population, Navigators provide information about not only ACA eligibility and enrollment but also Medicaid and employer coverage for low-income populations—as many people with low incomes transition across these coverage types.

The good news is that there are now 21 states operating their own state-based ACA marketplaces (Illinois launched their new SBM today) which also have their own marketing, outreach and navigation programs independent of the one operated by the HHS Dept. for HealthCare.Gov states. Still, that $90 million funding cut is gonna be pretty devastating across the other 30 states.

14. DON'T LET YOURSELF BE PASSIVELY AUTO-RENEWED!

It's always been a good idea to actively shop around the ACA marketplace each Open Enrollment Period to see whether there's a better value for the upcoming year, but it's even more important now.

Between the expiring federal tax credits, the less-generous APTC and MOOP thresholds, the changes in carrier participation (both new entries and exits), the changing supplemental financial assistance being provided in a dozen or so states, the seemingly counterintuitive pricing structure caused by "Silver Loading" and a host of other factors, you should absolutely NOT let yourself be "auto-renewed" this year!

My friend & colleague Louise Norris lists some important reasons for this:

In most states, you’ll have limited opportunities to pick a new plan after your coverage is auto-renewed. The auto-renewal process happens right after December 15, for people who haven’t manually renewed or selected a new plan. Since open enrollment extends into January in nearly every state (for now), enrollees in most states have until at least January 15 to pick a new plan if they ended up deciding that the auto-renewed option wasn’t the best choice after all.

Your subsidy amount will generally change from one year to the next. If your subsidy gets smaller, auto-renewal could result in higher premiums next year (and almost certainly will this year). If the cost of the benchmark plan changes, premium subsidy amounts in that area will also change. The benchmark plan for 2026 may or may not be the same plan that held the benchmark spot in 2025.

If you receive a subsidy, auto-renewal could be dicey even if the subsidy amount isn’t declining. If you rely on auto-renewal (as opposed to manually renewing and completing the financial eligibility determination process for the coming year), the exchange can renew your plan without a premium subsidy in certain circumstances. This includes situations in which you didn’t give the exchange permission to access your financial information in subsequent years, or if you failed to reconcile your premium subsidy on the prior year’s tax return.

If your plan is being discontinued at the end of 2025, auto-renewal will result in the exchange or your insurer picking a new plan for you. They will try to assign you to the plan that most closely matches the coverage you had in 2025, but selecting your own new plan is a better option.

Auto-renewal might result in a missed opportunity for a better value. Even if the plan you have in 2025 represented the best value when you selected it, there may be different plans available for 2025. Provider networks and benefit structures can change from one year to the next, as can premiums. You might still decide that renewing your 2025 plan is the best option for 2026. But it’s definitely better to actively make that decision rather than letting your plan auto-renew without considering the other available options.

And once again, all of this is even more true for 2026 due to the enhanced tax credits expiring at the end of 2025.

IN SHORT: SHOP AROUND, SHOP AROUND, SHOP AROUND!

P.S. I almost forgot a 14th "bonus" tip:

15. The Trump Regime is "generously" allowing anyone who isn't eligible for federal tax credits to enroll in a Catastrophic Plan instead.

Historically, Catastrophic Plans under the ACA have been restricted to enrollees who are under 30 years old or who qualify for a special Hardship Exemption.

Until now there've been very few Catastrophic Plan enrollees...just 54,000 or so this year out of over 24 million nationally, for numerous reasons:

- You usually have to either be under 30 years old;

- If you're over 30, you have to qualify for a limited range of hardship exemptions

- Applying & qualifying for a hardship exemption requires jumping through a number of administrative hoops

- Catastrophic plans don't show up as an option on the ACA exchange sites if the person applying for coverage is over 30

- You can't apply premium tax credits to them, vastly limiting the number of enrollees who'd have any reason to consider them

- The ACA exchanges don't go out of their way to call attention to them (with good reason)

- They aren't always the lowest-cost option even for those who don't qualify for subsidies

- They aren't even available in some areas (in 2025 there are no Catastrophic plans available in ten states (AK, AR, IN, LA, MS, NM, OR, RI, UT or WY), and in other states there are likely some counties which don't have any...I don't know what availability looks like for 2026, but I'm guessing it'll be similar)

So what's changing this year? Well, supposedly...

Under new HHS guidance, consumers may qualify for a hardship exemption to purchase a catastrophic plan on or off the Exchange if they are determined or expect to be ineligible for APTC or CSRs based on their projected annual household income....With a hardship exemption, eligible consumers can enroll in a catastrophic plan through HealthCare.gov.

If I'm understanding this correctly, they're vastly expanding the "hardship exemption" to enrollees of any age who earn more than 250% of the Federal Poverty Level (FPL), since that's the income threshold limit for Cost Sharing Reduction (CSR) eligibility.

Beginning November 1, 2025, consumers can apply for the hardship exemption in two ways:

- Apply online for Marketplace coverage on HealthCare.gov or through a certified partner. Household income will be reviewed as part of the application process.

- Submit a hardship exemption form [PDF, 946 KB] by mail.

Side note: Not only do you have to submit it by mail, the PDF won't even open unless you use Adobe Reader, which takes me back to the "Your Browser Doesn't Support Flash" days of the internet...

This guidance applies to consumers in FFE states and in States served by State-based Exchanges (SBEs) that choose to have exemptions processed through the FFE, which currently include all SBEs except California, Connecticut, Maryland, and the District of Columbia.

As far as I can tell, this means that the new policy will only be relevant to residents of 37 states.

Again, it's not necessarily a terrible thing, but it reminds me of a line from Apocalypse Now:

"We'd cut them in half with a machine gun and then give them a Band-Aid."

Good luck. We're all gonna need it.